The gross profit margin is helpful in determining how well a company is generating revenue from the costs involved in producing their goods and services. Gross profit margin is the percentage of revenue that exceeds the cost of goods sold. The higher the percentage, the more efficient the company's management is in generating profit for every dollar of the direct costs involved. In order to determine what's not included in the gross profit margin, we must first look at what goes into calculating gross profit.

Gross profit is the income a company earns after taking out the costs associated with producing and selling its products. Gross profit is shown as a whole dollar amount and is calculated by:

Gross profit = Revenue - Cost of Goods Sold

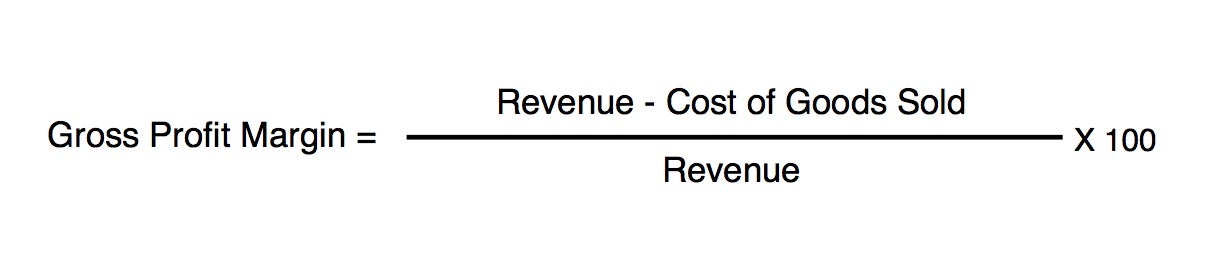

Gross profit margin is the percentage of profit generated from revenue and the costs involved in production. Gross profit margin is calculated as shown below:

Source : Investopedia

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article